[Today's post is by a new blogger on the scene, AbandonedCubicle.com, who's currently planning an early retirement by his mid-forties. He doesn't have everything neatly planned out for his life “after the cube” yet, but he's definitely had to learn a few things to get here. And today he shares some of these things, along with the hefty price tag he paid to acquire them ;) Enjoy!]

You've probably lost a huge sum of money before and not even known it. I know I have. It's not a fun lesson to learn, and unfortunately you don't catch it until a lot of the damage has been done.

In my case, it came in the form of opportunity cost. The things that you spend money on today that will end up costing you a lot more in the future. Even up to a million dollars more!

We live in a society that's constantly marketing to us everywhere we turn, and our friends and neighbors only seem to raise the bar for us. We were once fine driving our old clunky cars, and then our pal Joe drives by in a shiny new Lexus and all of a sudden we feel the need to upgrade! And so it goes with all other areas of life as well…

Over the past 20 years, and up until recently, I was that guy keeping an eye on what Joe was driving. And what new appliances were rolling into his house, how many channels he was getting off that dish satellite on his roof, etc etc. I was on financial “autopilot” – happy to be putting in a measly 10% into my 401(k), figuring, like everyone else, I'd be working until 62 or older.

Perhaps the saddest case of my consumer epic fails occurred fifteen years ago when I went out and bought a $1,000 Tag Hauer watch after getting a nice raise at my multi-national company. It sure was pretty! I thought I was James Bond, or at least the IT geek version of James Bond!

The not-so-funny part was getting laid off just a few weeks later. I don't think that ever happened to James Bond, did it? There were times when he handed over his famous license to kill after some silly misunderstandings, but me? I just handed over my server recovery cheat sheets and passwords (then rolled away in my vintage Lotus Esprit, of course…)

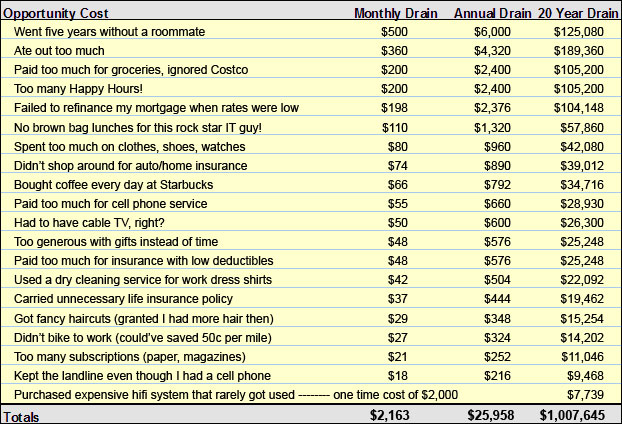

As for the rest of the lost million? Here it is, folks, in all its gory detail… The briefcase of cash thrown into Niagara Falls (to avoid capture by the Russians) which comprised of the following:

(The 20 Year Drain column totals assume that I'd instead put that money into

a low-cost S&P500 index fund, yielding 7% annual returns)

D'oh! That $1 million would have easily paved the way towards retirement in my early thirties, a full decade sooner than currently plan. With hindsight, though, comes a little bit of wisdom and an opportunity for redemption… And had I at least not stopped and evaluated when I did, I'd have gotten into my fifties, or even sixties, until I realized the path I was on!

Fortunately I stumbled upon Mr. Money Mustache's blog in the middle of a particularly rough stretch of work (some project from hell if I recall) and I completely devoured it. Then felt pretty bruised and beaten from the righteous financial left-hooks.

Had I really been that careless with my finances? I thought I was doing everything by the book?

Turns out I was doing everything by the book, only the book according to Madison Avenue. That mustachioed wonder provided a turning point for me, and in entered the Frugal James Bond…

Much smarter than before (and having sold that silly Tag Hauer on eBay!), I've since taken the reverse approach of those first 20 years and as Mike Holmes would say, “Made it Right!”

Eliminating, or reducing, those opportunity costs is now the priority. Throw in some improved income from the day job, the marvelous wife's business, and a few rental houses – and the Financial Spreadsheet of Doom from above starts to look a lot better.

The bottom line comes down to this: it's never too late to adjust your spending habits and make changes that will guide you to a rewarding retirement.

The changes we had to make were not hard choices. That's the sweetest part of all! We discovered that these expenses were in large part adding complications to our lives, and the simplifying of our budget led to better alternatives that not only saved us money, but quality time as well. It brought our focus back to what matters the most.

As for James Bond, well, I think he'd still be a pretty cool cat even with a Casio wristwatch (complete with hidden laser, of course.)

*******

Cubert AC blogs over at AbandonedCubicle.com, and lives in beautiful, but weather-wild, Minnesota, along with his wife and two kids. He writes about his personal journey leaving behind his corporate gig, and you can find him on Twitter @cubertAC.

EDITOR'S NOTE: Pretty frightening amounts to add up, eh? How much of that one million have YOU thrown away in the past 20 years? I can shamefully answer to at least $600,000 myself…

No comments:

Post a Comment